Container ship attacked while crossing Red Sea! Shipping costs have been as high as $10,000...

At present, a container ship in the Mediterranean Sea was attacked while crossing the Red Sea in the afternoon. It is the latest sign of an escalating crisis in the Red Sea.

The container ship was attacked while crossing the Red Sea

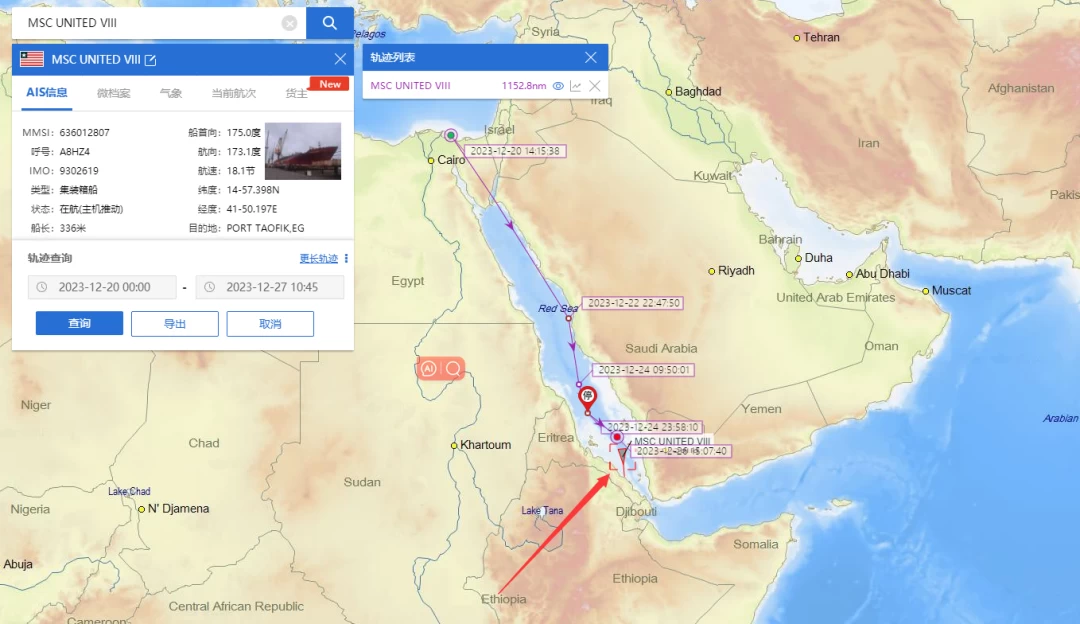

On December 26, local time, Yemen's Houthi armed forces issued a statement saying that after three warnings were rejected by the merchant ship MSC United in the Red Sea, Houthi armed forces fired missiles at it.

Later, in a statement, MSC Mediterranean Shipping confirmed that its container ship MSC United VIII was attacked en route to Pakistan.

The MSC United VIII was sailing from King Abdullah Port in Saudi Arabia to Karachi, Pakistan.

MSC also said all crew members were safe, no injuries were reported and a full assessment of the ship was being carried out.

"Our priority remains the protection of the lives and safety of seafarers, and until we can be sure that their safety is guaranteed, MSC will continue to divert ships scheduled to transit the Suez Canal to the Cape of Good Hope."

Yemen's Houthis on Tuesday claimed responsibility for the missile attack and vowed to continue attacking Israeli ships and ships bound for Israel.

Since the outbreak of the new round of Palestinian-Israeli conflict, the Houthi armed forces have continuously attacked ships "associated with Israel" in the Red Sea on the pretext of "supporting Palestine".

That has forced the world's shipping giants to avoid the Red Sea and bypass the Cape of Good Hope, raising shipping costs and causing delays.

The resumption is fraught with uncertainty

It is understood that Maersk and Hapag-Lloyd were preparing plans to resume navigation in the Red Sea before MSC United VIII was attacked during its attempt to pass through the southern Red Sea.

Maersk, the world's second largest container shipping company, said on Tuesday that plans were being made for the first ships to pass through the Red Sea as a US-led multinational joint escort aimed at protecting shipping from Houthi attacks was being deployed to resume the east-west route through the Red Sea.

At the same time, Maersk also stressed that the overall risk in the region has not been eliminated, and if the security situation changes, it will reassess and start the reroute plan again.

German shipping company Hapag-Lloyd spokesman said 26, will decide today whether to resume the Red Sea route. Last week, Hapag-Lloyd said it would recourse 25 ships by the end of the year to avoid the area.

As a result of the attack on the container ship MSC United VIII, whether Maersk and Hapag-Lloyd will continue to resume passage through the Suez Canal ultimately depends on official news or facts.

As it stands, it will not be easy for shipping companies to return to service. For them, the safety of the shipping lanes is a primary concern.

Zheng Jingwen, senior market analyst at the International Shipping Research Institute of the Shanghai International Shipping Research Center, said that other liner companies are currently in a wait-and see state, after all, although there are multinational warships escort, but whether it can deter the Yemeni Houthi armed forces is still unknown. Moreover, many ships have already begun to divert, and it is unlikely that the Red Sea route will be resumed immediately.

The freight rate for a single box exceeded 10,000 dollars

The Red Sea-Suez Canal route is the main route for China and Asian countries to Europe, and its geographical importance is needless to say. Affected by the situation of the Red Sea, the freight rates of Asia-Europe and other shipping routes have been most significantly affected.

According to CNBC, the cost of shipping a 40-foot container from Shanghai to the United Kingdom is as high as $10,000. A week ago the rate was $2,400. Meanwhile, trucking prices in the Middle East have more than doubled.

One shipper importing commodities from China to the UK said carriers were refusing to accept his heavy boxes, although he said he was offered $3,000 per 20ft by one company.

"A month ago, it was $435 per 20 feet." The shipper said.

Peter Sand, principal analyst at freight benchmarking firm Xeneta, pointed out that although the current market freight rate is not yet at the average level, shippers may have to pay more for some goods that need to be transported urgently.

"The arrival of the Lunar New Year, combined with the uptick in demand for the upcoming season, makes the situation tighter for all players," Sand further said. "Huge peak freight rates are coming."

Alan Baer, CEO of logistics giant OL USA, pointed out that as ships need to be turned in real time to avoid the risk of Houthi attacks in Yemen, sea carriers have quickly adjusted their quotes to cover the increased costs.

Compared to the changes during the pandemic, the adjustment has been faster, with freight rates even rising by 100 to 300 percent on some trade routes.

According to data released by Kuehne + Nagel, 313 vessels have been identified as affected by the situation in the Red Sea as of December 22. The total capacity is expected to be 4.2 million TEUs. According to estimates by MDS Transmodal, a maritime transport data company, the value of diverted cargo is around $105 billion.