HMM third quarter profit is expected to surge analysts: the real surprise is about to be staged

Despite the drop in spot freight rates, they are still well above pre-pandemic levels, and analysts said: "The real surprise is in the third quarter", with South Korea's flagship liner Hanshin Shipping (HMM) expected to report a 1,250 per cent increase in operating profit in the third quarter compared with the same period last year.

On September 6, the Shanghai Export Container Comprehensive Freight Index (SCFI) released by the Shanghai Shipping Exchange was 2,726.58 points, down 8.0% from the previous period. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $3459 /TEU, down 10.8% from the previous period. Mediterranean routes, the market and European routes to keep pace, spot market booking prices continue to decline. The freight rate of Shanghai port exports to the Mediterranean basic port market was 3823 US dollars /TEU, down 6.4% from the previous period. The freight rate of Shanghai port exports to the West and East basic port markets of the United States was 5,605 US dollars /FEU and 7511 US dollars /FEU, respectively, down 8.7% and 11.0% from the previous period.

Falling freight rates are not enough to worry liner companies. Analysts stressed that although the SCFI has fallen below 3,000 points, it is still nearly 2,000 points higher than the end of September last year (886.85), and nearly 1,000 points higher than in March this year. It is expected that liner companies' earnings in the third quarter will be even better than in the second quarter, and "freight rates will remain at the high end of the historical average of the container market".

In the Red Sea crisis, the diversion effectively absorbed 8% of the market capacity, resulting in a reversal of the supply and demand situation. "Uncertainty in the Middle East is becoming the norm," says one industry insider.

Analysts expect HMM to maintain its strong performance in the second half of the year after delivering solid results in the second quarter. In the second quarter of 2024, HMM achieved operating income of 2.6 trillion won (approximately $1.97 billion), an increase of 25% year-on-year; Operating profit rose to 644.4 billion won (about $480 million), a 302 percent year-on-year increase. Analysts expect that in the third quarter, HMM's operating income is expected to reach 3.2 trillion won (about $2.38 billion), and operating profit is expected to surge to 1.0 trillion won (about $760 million), up 50% and 1,250 percent year-on-year, respectively.

After failing to go private this year, HMM announced an ambitious plan to boost its global competitiveness, with plans to expand its non-container fleet from 36 to 110 ships by 2030. By 2030, HMM container ship capacity will grow to 130 vessels and 1.5 million TEU.

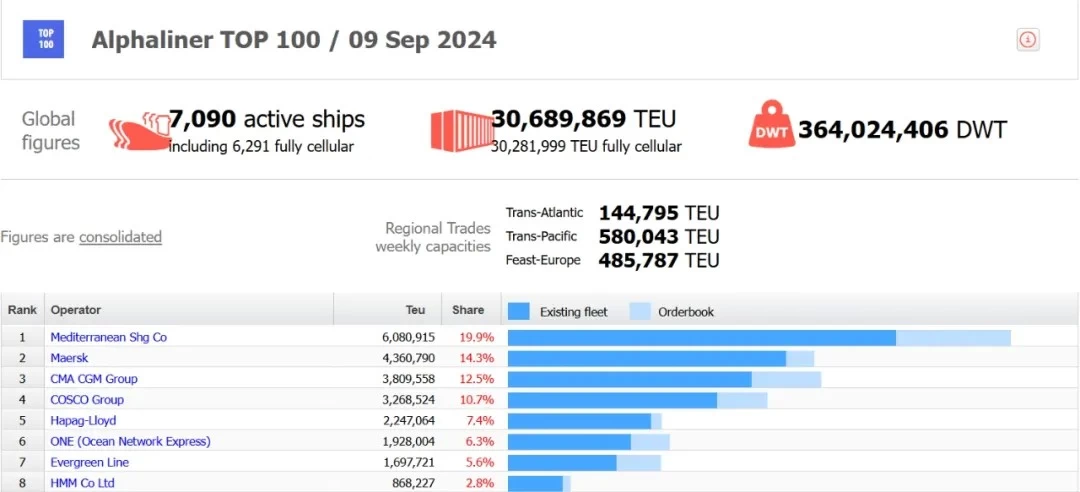

According to Alphaliner's latest data, HMM ranks 8th among the top 100 global liner companies in terms of capacity, operating 78 vessels, including 52 owned vessels and 26 chartered vessels, with a total capacity of 868,000 TEU. In addition, HMM also holds 14 vessels with a total of 125,000 TEU of new shipbuilding orders.

Sunny Worldwide Logistics has more than 20 years of freight forwarding history,and over half of staffs working in Sunny about 5-13years.Emergency solutions must be offered with 30 minutes if any. You may not find other companies like us in Shenzhen.